Dimitar Blagoev

ORCID iD: 0000-0003-2350-7341

University of National and World Economy – Sofia, Bulgaria

Kalin Karev

ORCID iD: 0009-0001-3645-158

University of National and World Economy – Sofia, Bulgaria

https://doi.org/10.53656/igc-2024.03

Pages 60-71

Abstract. In the present study we analyze the territorial distribution and the activities of the companies in the recycling industry in Bulgaria, and especially in the central-south region of the country. Our primary goal is to make retrospective analysis and to identify the future trends of progression of the companies in the recycling industry in the specified country region. We use relevant statistical data, associated with particular economic indicators –turnover, long-term assets value, short-term assets value, number of employees, value of investments, etc. On a regional level we focus on some macroeconomic indicators – gross domestic product (GDP), gross value added (GVA), foreign direct investment (FDI), etc.

Keywords: Recycling Industry; Economic Development; Green Economy; Central-South region

JEL: Q26, Q51, L25, L60, O41

- Introduction

The concept of a consequential climate change, driven by the humanity activities, led to a substantial reconsideration during the last two decades of the global economic development. The contemporary view is for economy of a circular type rather than a linear economy. The ideology further evolves and one of the recent approaches is the so called Regenerative economic theory. The belief which the circular economy is based on relies on much better utilization of the Earth’s natural resources. Thus, any processed form of these resources could be recycled and used again. The focus is also on the ordinary products and the fast natural degradation. In this regard, the recycling industry appears to be a key element in the modern green economy global initiatives.

Recycling industry is a key for going from linear to circular sustainable economy (Doneva, 2021). Many scientists work in researching the issues of the green economy, sustainability, corporate social responsibility, as an element of the circular and sustainable economy, etc. related research areas (Biolcheva & Valchev, 2023; Dragozova & Kovacheva, 2023; Sterev, 2023).

The transition to circular economy is opportunity for establishing concurrent advantage of stable base (Krasteva, 2021)

Materials that are suitable for recycling are mainly classified as:

– dangerous – harmful for the flora and fauna of the World and they can make irreparable damages over them;

– nondangerous – they can be recycled, do not have risk for the living and after been recycled can be reused for manufacturing new materials or making the same type product.

Undoubted problem for the environment is the plastic and rubber wastes. More than one third of the daily used products made from those materials are turning into garbage. The same and even to a great extent is valid for aluminium, steel, glass, paper, textile, leather and different types of electrical and electronic products, batteries, etc. The majority of the mentioned wastes do not rot, do not dissolve in water and are very slow taken by the air. Having this in mind their accumulation and disposal need to be stopped and to search for solution of the question for their accumulation and reuse (Dimitrova, 2017). As the most popular technologies for recycling are: burning, pyrolysis, burying, composting and briquetting (Costoff, 2020).

The recycling of waste is written in law norms, directives and regulations where are explained clearly the places for storing, transporting, sorting, processing and the way of recycling them. The main aim is to achieve the safest destruction or after their processing to use the maximum utilization of the waste (NORD Holding, 2023; Terzieva, 2023).

- Research methodology

For the purpose of the present study we will use the method of the technical (comparative) analysis and the trends for specified period. We are going to used available statistical data for the main economic indicators for period of 5 years. The aim is to receive full of data statistical order (data line), which will allow us to outline the relevant trend and short term of prediction for the direction of how to sector for recycling industry will develop in the planned South-Central region in the country.

Macro level indicators

- Gross domestic product (GDP) – For the purposes of the research the date for the GDP that is calculated by manufacturing method. (National Statistical Institute, 2024).

- Foreign direct investment – according to definition of World Trade Organization (WTO) (World Trade Organization, 1996; Vranchev, 2020).

Micro level indicators

- Number of enterprises – Building, functioning and the transformation of the enterprises is based on the requirements of the active trade law.

- Turnover – According to the law for small and medium enterprises – “Annual turnover” is the net size of the incomes from the usual activities of the enterprise. The turnover is the net amount of sales and/or services of specific company. Normally it is determined annually and that is why it can be called also “annual turnover”.

- Short-term assets value – part of the funds of the enterprise which in the form of material reserves take part in one manufacturing cycle one time in the manufacturing process.

- Employees – The staff includes all of the employees with specific activity in the enterprise.

- Investments (long-term assets acquisition costs) – long-term assets acquisition costs characterize the investment activities of the enterprise. According to the classification introduced with Law of the accounting in the long-term assets value includes more important elements: estate, buildings, machines, facilities, transporting vehicle, inventory etc. (Georgiev et al., 2008, pp. 121 – 130).

- Results and discussion

Macro indicators analysis

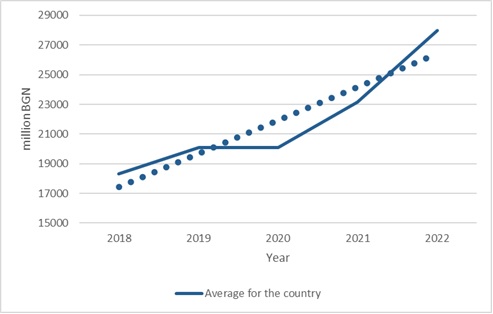

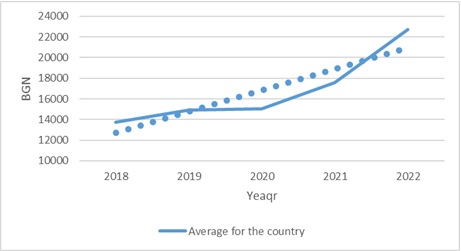

For the period of 5 years GDP has growth with 56,5% (figure 1). In the same time the generated GDP per capita has growth with 65% (or approximately 0,7 times). This shows that there is an improvement also in the productivity of the work of the employees (which may also be due to the implementation of more performance technologies and assets). Because the data for generated GDP and GDP per capita (figure 2) are by current prices, it is good to correct these values with the cumulated inflation for the same period. According to data from National Statistical Institute (NSI) the accumulated inflation for the period from January 2018 year to January 2023 year is 35,9%. This shows that even that the temp of inflation during this period is not so slow, over the macro indicators that we investigate there is a positive trend of change with approximately +20 – 25%.

Figure 1. Dynamic of Gross domestic product in Bulgaria 2018-2022 Source: National Statistical Institute

Figure 2. Dynamic of Gross domestic product per capita in Bulgaria 2018-2022 Source: National Statistical Institute

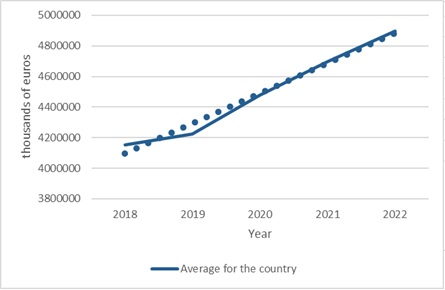

Another important macro indicator for economic potential and economic attractiveness is the accumulated volume of Foreign direct investments (FDI) which are made for the specified period (figure 3).

Figure 3. Dynamic of Foreign direct investments in Bulgaria 2018-2022 Source: National Statistical Institute

For the period of 5 years (2018 – 2022) foreign direct investment in the national Economy have increased with 18%. Recalculated with cumulative temp of the inflation for the period (which have been shown above and was approximately 35,9%) shows some temp of decrease of the Foreign direct investment. Based on this, we can make conclusion that Bulgarian economy lose competitiveness and attractiveness for the foreign investors. The trends in the investments (in this specific case of the FDI) will be used as a base for comparison with the implemented investments in assets of the enterprises that are operating in the sector of recycling industry.

Micro indicators analysis

According to methodological point of view the analysis will continue on level sector with aggregated data from level enterprises. The results are shown for enterprises from the sector of recycling industry by code of the economic activity from Statistical classification of economic activities in the European Community (NACE) 2008 (table 1), as shown:

Table 1. Type of economic activities related on recycling industry

| Code | Activity |

| 38.1 | Waste collection |

| 38.2 | Processing and disposal of waste |

| 38.3 | Recycling of materials |

| 38 (national average) | Collection and disposal of waste; material recycling (national average) |

| 38 (total for the region) | Collection and disposal of waste; recycling of materials (total for the region) |

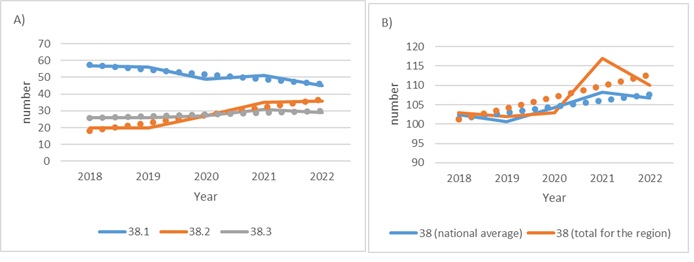

A) Number of enterprises

Figure 4A shows the number of the enterprises of the recycling industry that are performing activity in the South-Central region. It can be seen that the enterprises that are performing activities of collecting waste are decreasing during the whole period of research, as from 57 in 2018 year their number decreased to 45 in 2022 year, which decrease is with approximately 21%. The opposite trend is seen in the activity of processing and disposal of waste. In it the increase of the enterprises is with 80% and this is during the whole period of the research, as from 20 in the beginning they become 36 in the end of the specified period. Similar trend of increase during the period from 2018 to 2021 years is seen also in the enterprises that are performing the activity of recycling materials, as their number from 26 become 31. During the last year of the researched period can be seen decrease in their number to 29. Despite the decrease compared to the starting period of the research it can be seen increase in the number of enterprises with 11,5%.

Figure 4B shows the change of the number of the enterprises of the recycling industry total for the South-Central region and average for the country. From it can be established that the number of the enterprises total for the region is staying almost the same with a little temp of increase in the end of the researched period, as the total increase for the period is 4,07%. Similar trend is seen also in the enterprises for recycling average for the country until 2020 year as in the end of the researched period are seen hesitations with incensement of their number to 117 in 2021 year and after that decrease to 107 in 2022 year. Despite the shown decrease in the end of the research period it can be seen increase from 6,80% in the considered enterprises.

Figure 4A and 4B. Dynamic of number of enterprises 2018-2022 Source: National Statistical Institute

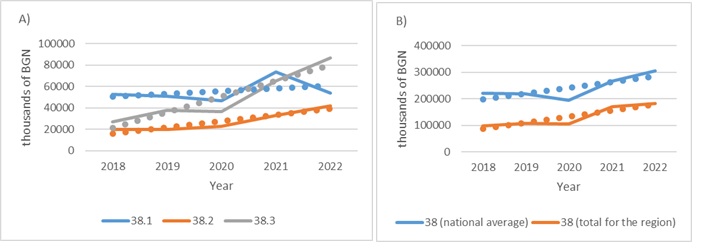

- B) Turnover

The turnover of the enterprises that are in the recycling industry from South-Central region are shown on figure 5A. From the figure we can see that the turnover of the enterprises for processing and disposal of waste increases by the whole specified period, as from 19619 thousand BGN in 2018 year came to 42025 thousand BGN in 2022 year. This increase is with 114,2%. Similar trend for the turnover is seen during the specified years also in the enterprises for collecting waste and recycling of materials to 2021 year, after that year there is sharp decrease of the turnover in the enterprises for collecting waste from 73309 thousand BGN in 2021 year to 53922 thousand BGN in 2022 year and the temp of the turnover continues to increase in the enterprises for recycling of materials from 65032 thousand BGN in 2021 year to 86830 thousand BGN in 2022 year.

Almost similar is the trend for the dynamic of the turnover in the enterprises average for the country and the total for the South-Central region, as the decrease of the turnover in 2020 year is typical for both of the considered groups of enterprises (figure 5B). During the period 2021 – 2022 years can be seen delay in the temp of increasement of the turnover for the researched region from 171307 to 182777 in comparison to this of average for the country from 266483 thousand BGN to 306331 thousand BGN or increase with 40,3%.

Figure 5A and 5B. Dynamic of turnover of enterprises 2018 – 2022 Source: National Statistical Institute

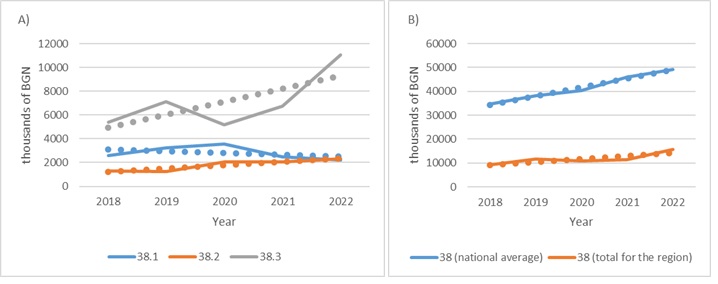

- C) Short-term tangible assets

During the investigated period the value of the used short-term assets from the recycling industry in the South-Central region have changeable character for the different activities (figure 6A). Makes an impression that despite the different number of enterprises for collecting waste and processing and disposal of waste during the last years of the researched period (accordingly 45 and 36 enterprises) short-term assets value are almost the same and also the short-term assets value for the activities of recycling materials and for total enterprises in central-south region have almost the same trends of development.

Comparing the value of the short-term assets value average for the country with that is total for the South-Central region (figure 6B) can be seen that the whole increase in the region is bigger than the average for the country accordingly 68,58% and 41,65%.

Figure 6A and 6B. Dynamic of short-term tangible assets of enterprises 2018-2022 Source: National Statistical Institute

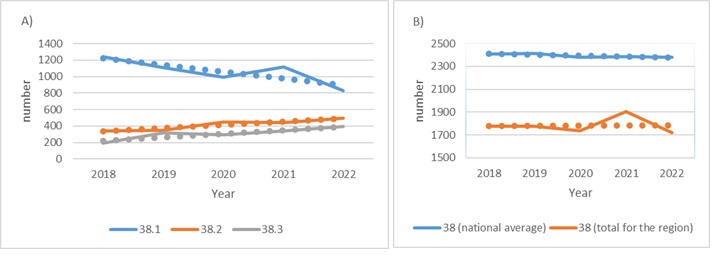

- D) Employees

The number of employees in the enterprises that are performing activities of recycling materials in South-Central region are shown in figure 7A. From it can be seen that the employees that are working for collecting waste during the whole researched period decrease continuously from 1242 employees in the begging to 833 employees in the end of the period. The decrease is 32,9%. The opposite trend almost continuous increase of the employees is seen in the processing and disposal of materials and recycling materials, as the increase is with 45,7% (from 339 employees in 2018 year to 494 employees in 2022 year) and 104% (from 192 employees in 2018 year to 392 employees in 2022 year). Comparing the change in the employees at national average and total for the South-Central region (figure 7B) can be seen bigger decrease of the employees total for the researched region with 3,05% (from 1773 employees in 2018 year to 1719 employees in 2022 year) in comparison to the average change for the country – 1,18% (from 2408 employees in 2018 year up to 2379 employees in 2022 year).

Figure 7A and 7B. Dynamic of number of employees in enterprises 2018-2022 Source: National Statistical Institute

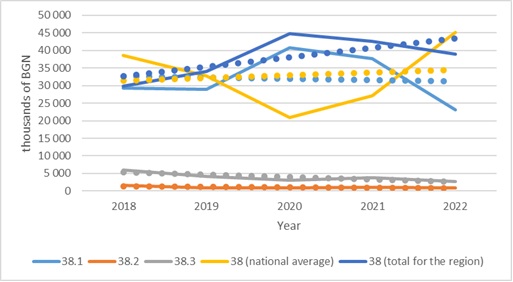

- E) Investments (long-term assets acquisition costs)

The costs for long-term assets acquisition are shown in figure 8. From it can be seen that in all of the three considered activities connected to recycling of materials there is almost the same trends of development – decrease in the made costs for long-term assets acquisition according to collecting waste with 20,9% (from 29348 thousand BGN in 2018 year to 23200 thousand BGN in 2022 year), for processing and disposal of waste with 44,99% (from 1536 thousand BGN in 2018year to 845 thousand BGN in 2022 year) and with 55,25% for recycling of materials. By comparing the made costs for long-term assets acquisition for the country with those of the South-Central region can be seen interesting trend. Until 2020 year can be seen increase in the costs for long-term assets acquisition for the investigated region and decrease the specified costs for the country. After 2020 year until the end of the researched period can be see the opposite trend of decrease of the costs for long-term assets acquisition in South-Central region and for the lasts years they get to 38980 thousand BGN and increasing those average for the country to 45207 thousand BGN. During the last year they exceed those of the investigated region with approximately 16%.

Figure 8. Investments in enterprises (Costs for the acquisition of Fixed Tangible Assets) 2018-2022 Source: National Statistical Institute

- Conclusions and summaries

Based on the analysis that was made we found out that the most increase of the number of the enterprises during the researched period of the South-Central region is seen for the activity of processing and disposal of waste. Despite this trend the most numerous in the researched region are staying the enterprises that are doing the activity of collecting waste. Their turnover is staying considerably lower than those of the enterprises that are recycling materials. Makes impression that despite the different number of enterprises for collecting waste and those for processing and disposal waste their short-term assets value is almost the same. The number of employees taking part in the activity of collecting waste decreases during the whole investigated period. The trend of increase can be seen in other two activities and the most significant increase is in the employees in the section of recycling materials. From the made investments can be established decrease in the made costs for getting long-term assets value and for the three activities linked with the recycling of materials for the researched region. This may lead to negative trends in long term plan that will get to losing competitiveness. Comparing the development of the recycling industry in South-Central region with the average data from the statistics for the development of this industry for the country can be seen bigger decrease in the number of employees and the made costs for long-term assets acquisition during the last years of the investigated period in South-Central region in comparison with those that are average for the country.

Acknowledgement

We acknowledge the financial support of the project “Research and Development of a Conceptual Model of an Academic Innovation-based Incubator”, №NID NI-3/0222/A, R&D Fund, University of National and World Economy, Sofia, Bulgaria.

REFERENCES

Biolcheva, P., & Valchev, E. (2023). Increasing CSR Through a Methodology for Intelligent Personal Efficiency of Employees. Strategies for Policy in Science and Education, 31(6s), 126 – 137. https://doi.org/10.53656/str2023-6s-11-inc

Costoff, D. (2020, November 4). What are the Legal Requirements for E-waste Collection and Recycling? Ecologica. https://ecologica.bg/2020/11/04/kakvi-sa-zakonovite-iziskvaniya-za-sabirane-i-retsiklirane-na-elektronni-otpadatsi/

Dimitrova, K. (2017). Innovative and Intelligent Solutions for Recycling of Household Waste in Bulgaria. Annual Journal of Technical University of Varna, 1(1), 52 – 66. https://doi.org/10.29114/ajtuv.vol1.iss1.38

Doneva, D. (2021). Еco-innovations and Resource Effectiveness. In Sustainable development and socio-economic cohesion in the 21st century – trends and challenges: Conference Proceedings: Vol. II (pp. 172 – 178). Tsenov Academic Publishing House. [in Bulgarian]

Dragozova, E. & Kovacheva, S. (2023). Research on the Sustainable Development Competences of the Landscape Architect in Practice. Strategies for Policy in Science and Education, 31(6s), 56 – 67. https://doi.org/10.53656/str2023-6s-5-res

Georgiev, I., Hutova, V., Popov, G., Andreeva, D., Yovkova, Y., Marinova, Y., Kamenov, Y., Ignatova, N., Shterev, N., Radev, R. & Blagoev, D. (2008). Economic of the enterprise. University Publishing House Stopanstvo. [in Bulgarian]

Krasteva, I. (2021). Circular Economy – Model for Increasing the Sustainability of Agriculture. In Sustainable development and socio-economic cohesion in the 21st century – trends and challenges: Conference Proceedings: Vol. II (pp. 625-631). Tsenov Academic Publishing House. [in Bulgarian]

National Statistical Institute. (2024). Methodological Notes for Calculating of GDP by Production Method. https://www.nsi.bg/sites/default/files/files/metadata/GDP_1.2.1_Methodology.pdf

NORD Holding. What are the Most Recyclable Materials? (2023, April 3). https://nordholding.bg/novini-bg/koi-sa-naj-retsikliruemite-materiali/

Sterev, N. (2023). Pre-Incubation Toolkits for Academic Entrepreneurship Fostering: Bulgarian Case. Strategies for Policy in Science and Education, 31(3s), 90 – 103. https://doi.org/10.53656/str2023-3s

Terzieva, A. (2023). Analysis of the Requirements for Storing and Storage of the Chemical Substances and Mixes. In Management in unpredictable business environment: Conference Proceedings (pp. 11 – 15). University of Chemical Technology and Metallurgy. [in Bulgarian]

Vranchev, K. (2020). Impact and Effectiveness of the Foreign Direct Investment over the Economical Growth. Annual almanac scientific researches of PhD students, 13(16), 330. [in Bulgarian]

World Trade Organization. (1996, October 9). Trade and Foreign Direct Investment Report. [Press release]. https://www.wto.org/english/news_e/pres96_e/pr057_e.htm